Let's talk money

Having less really isn't so bad

Over the past months I have written a lot about career change: my own story, how I’m doing it and some advice that may or may not be helpful.

These days, my income comes from a range of sources and I’m starting to consider myself to be a multi-hyphenate.

What I haven’t really written about is the financial reality of going from having a full-time, well-paid job with benefits, to being only partially employed by an organisation and the rest of the time going it alone.

At the moment, I have a part-time salaried teaching job. It’s a maternity cover until August 2024 and I have no idea if it will continue after that, or, if I want to continue doing it. That’s a decision for a later date and not something I plan to worry over right now.

So, I do have a regular part-time income which comes with a pension and some benefits but this is significantly less that what I was earning before July. I have much fewer responsibilities in this job than when I was heading up a large department so I’m not only earning a fraction of a salary, but that overall salary is lower.

Lots of calculations were done before accepting this job, and I knew that if it came to it I could just about pay my share of the mortgage/bills with this income alone, but I wouldn’t have anything left over.

Here I am, a few months in and here’s what I’ve learned so far.

1. Less cash means more careful planning

I’m much more aware than ever before of exactly how much money I have in my bank account. These days I check my balance daily and know precisely what is going out and what is coming in.

My salaried income is almost entirely used to pay the bills and so if I want to go out for dinner with friends or buy some new clothes, that money has to come from anything extra I’ve earned from my self-employed and varying income.

This in itself makes me much more mindful about what I purchase and where I go. When I had regular money coming in, I was wasteful. I can see that now. I was lazy when it came to researching something I wanted to buy, because I probably didn’t have the time. Instead, I would click buy and sometimes be disappointed when the item arrived because it wasn’t quite what I wanted. Of course, I also most likely wouldn’t bother to send it back.

These days, instead of buying a coffee on the way to the station, I make a coffee at home and put it in my mini flask. It may seem obvious to those of you that have been doing this all along, but doofus here had been wasting anything up to £4 a time on a mediocre coffee.

2. Socialising is REALLY expensive

I live in a suburb of south west London and so I can easily hop on a train and go and meet up with friends in central London for drink or dinner. This is wonderful in theory, but in reality London is seriously expensive. Even the most bog-standard bar can set you back some serious £££ and that combined with train fare can make a casual drink cause a hefty dent on the month’s spending. I haven’t stopped going out with friends, but often I will think of other ways we can meet. Perhaps meeting at a free exhibition and buying a takeaway sandwich or, better still, bringing a sandwich with me to sit and eat by the river. Or, in the evening heading to a place with a simple but tasty, good-value menu that I can plan the cost of in advance. Those places are getting harder to find in London, but with a little research they can be discovered.

3. Having less cash is making me more creative and enterprising

This follows on from the point above. When you don’t have cash to throw at a problem, you have to be more creative. One of my big spending bugbears is the cost of greetings cards. I mean, don’t get me started on greetings cards in general, but increasingly it’s difficult to find anything for less than £3.50. Combine that with the cost of a stamp and you’ve spent a fiver before any kind of gift has been considered.

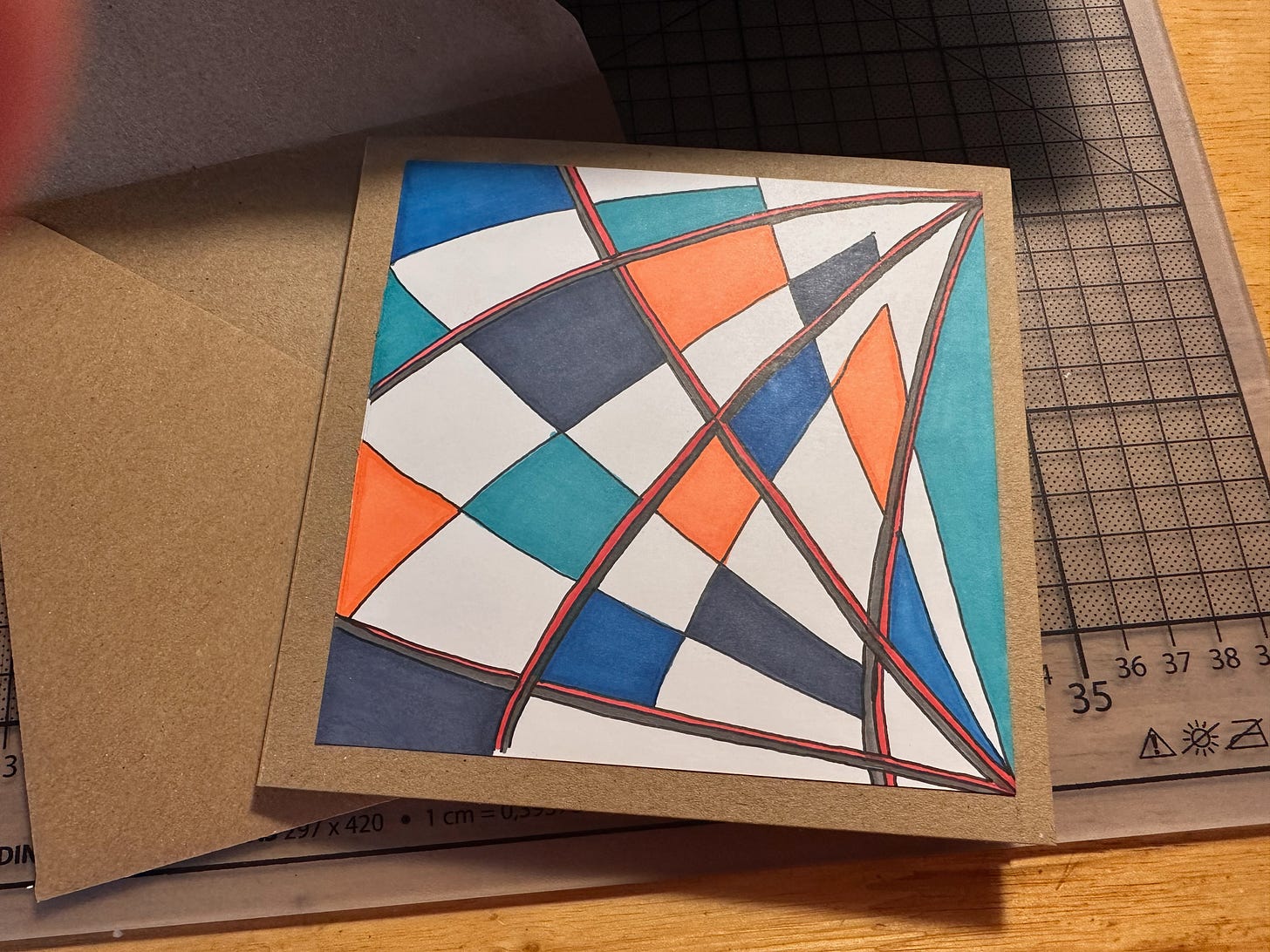

Last week was our wedding anniversary. I went to look at some cards. They were all terrible and cheesy and not the kind of thing my husband would like. That combined with the cost, made me think that I could make something instead. I went home, dug around for some old crafting materials and found a pack of blank cards. I set to work and here is my creation:

Would I have done this on our anniversary last year? Not a chance. I didn’t have so much time, but it also wouldn’t have even crossed my mind. Now, this is no work of art, but I enjoyed the process of designing and choosing colours for this card and then carefully considering what to write inside it. I took time and care over it, and so it was a more meaningful experience all round.

4. I don’t need lots of things

I’m very fortunate to have a nice home and comfortable surroundings, I fully acknowledge that. Part of that has come from working hard over the past 15 or so years and earning the money to pay for this lifestyle. Going forward, it’s hard for me to see what I could possibly need to acquire that would improve my life significantly. Sure, it’s nice to buy some expensive cushions but in reality they are just cushions. I’m feeling content with what I have, and have spent quite a bit of time going through all of my clothes recently, selling unwanted items and making myself fully aware of exactly what I do have.

5. Being diligent with self-employed earnings is vital

Whenever I get paid from any of my freelance jobs, I immediately put 50% of it into a savings account labelled ‘tax and national insurance’. I almost certainly (unless the Substack paid subs go wild as a result of this post🤪) won’t have to pay this much in tax and national insurance when I do my tax return next year, but I am secure in the knowledge that I have plenty put away to cover that bill. If I’m lucky, there will also be some left over which will be extra savings.

I strongly believe in my moral obligation to pay tax and so it’s vital that I do not see my self-employed income as being 100% mine, because it isn’t.

Right now, having less money coming in each month isn’t feeling as scary as I expected it to be. I suppose the key to all of this is being responsible and aware. I won’t let myself bury my head in the sand. The situation may change over time, but I will continue to monitor and reflect, as I’m doing now. Let’s see what the next few months bring!

Love your honesty here, I relate to so much! Socialising is expensive!!! I’m feeling a bit nervous about party season in the horizon and all of the Christmas presents but love the idea of being more crafty, that card you made is so lovely! ❤️

Loved this post and couldn't agree more! #3 "Having less cash is making me more creative and enterprising." is something I have found to be true as well. Creativity can thrive within perimeters like having a budget, or a specific topic to work with, etc. I'm sure your present for your husband on your anniversary meant so much more than just buying a present because you put so much thought and care into it.